property tax on leased car in va

Personal property taxes that are 1 assessed annually and 2 based on the value of the personal property are itemized deductions for federal tax. Virginia auto taxes apply to the vehicle price before incentives or rebates.

Who Pays The Personal Property Tax On A Leased Car

Motor Vehicle Sales and Use Tax.

. Sales tax in Virginia is levied on the ENTIRE value of. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles.

To learn more see a full list of taxable and tax-exempt items in. Titling Your Leased Vehicle. Ownership and Tax Statements.

For vehicles that are being rented or leased see see taxation of leases and rentals. For vehicles that are being rented or leased see see taxation of leases and rentals. All applicable fees are due at the time of titling by the lessor such as the 15 title fee and the.

This code is 58 in codeVirginia levies a 4 percent levy on residential property taxes between December 2016 and September 2017If the vehicle has a gross sales price greater than 75 15 percent Motor Vehicle Sales and Use SUT Tax appliesDealers processing fees. If you find a vehicle for 20000 that includes a 2000 rebate this lowers the price to 18000. In VA you are taxed up front on the cap cost of the leased car sales tax rate of 6Fairfax county and then 415 tax rate based on the value of the car each year.

Does Your Vehicle Qualify for Personal Property Tax Relief. This page describes the taxability of leases and rentals in Virginia including motor vehicles and tangible media property. In car leasing as in buying there can be charges fees costs and taxes that often surprise newcomers.

For example in Alexandria Virginia a car tax runs 5 per 100 of assessed value while in Fairfax County the assessment is 457 per 100. June 6 2019 203 AM. In addition to taxes car purchases in virginia may be subject to other fees like registration title and plate.

The Virginia Department of Motor Vehicles collects these fees separately from the sales taxes that are collected from the Virginia Department of Taxation. Virginia collects a 400 state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January.

If I end up. Santefejoe December 7 2019 943pm 1. Let me reconsider a lease as an option over a low-mileage CPO to try to reduce annual property taxes with the lower car value.

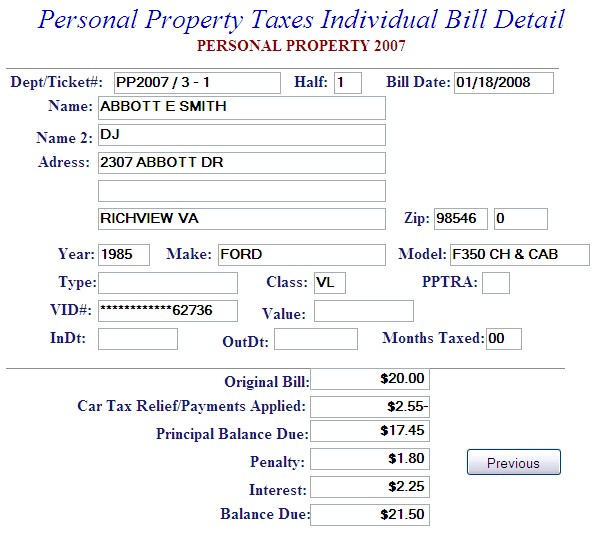

Vehicle Personal Property Tax. If the vehicle is leased by an individual does the leasing company pay the tax without reimbursement from the individual. For example in Alexandria Virginia a car.

The vehicle is registered in the name of the leasing company and the car tax bills are sent directly to the leasing company for payment. Be owned by a natural person or leased by a natural person under a contract requiring the natural person. Vehicles leased by a qualified military service member.

A leased vehicle is any vehicle used by a person or entity lessee offering some form of compensation to use the vehicle and who has an agreement with the owner of the vehicle lessor for such use for a period of twelve months or more. Ownership and Tax Statements. The leased vehicle will be titled in the name of the lessor owner.

Is more than 50 of. Texas does not tax leases. Any person engaged in the business of leasing or renting tangible personal property to others is required to register as a.

Six dollars is due to the lessor. Effective July 1 2016 unless exempted under Va. My current S3 lease expired in January.

In addition to taxes car purchases in Virginia may be subject to other fees like registration title and plate fees. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and title of a vehicle. Personal property tax relief is provided for any passenger car motorcycle or pickup or panel truck having a registered gross weight with DMV of 10000 pounds or less on.

Virginia VA Sales Tax and Lease Purchase Option. The lessor may be known as a leasing.

Who Pays The Personal Property Tax On A Leased Car

Virginia Vehicle Sales Tax Fees Calculator

Who Pays The Personal Property Tax On A Leased Car

Do I Pay Personal Property Tax On A Leased Vehicle House From The Picture

Personal Property Tax Portsmouth Va

Virginia Vehicle Sales Tax Fees Calculator

Who Pays The Personal Property Tax On A Leased Car

Virginia Sales Tax On Cars Everything You Need To Know

Which U S States Charge Property Taxes For Cars Mansion Global

Vehicle Taxes Frequently Asked Questions Tax Administration

What To Know If You Have An Accident In A Leased Vehicle Freeway Insurance

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Who Pays The Personal Property Tax On A Leased Car

Do I Pay Personal Property Tax On A Leased Vehicle House From The Picture